Why the Memecoin Supercycle is Failing: 3 Reasons You’re Doing it Wrong

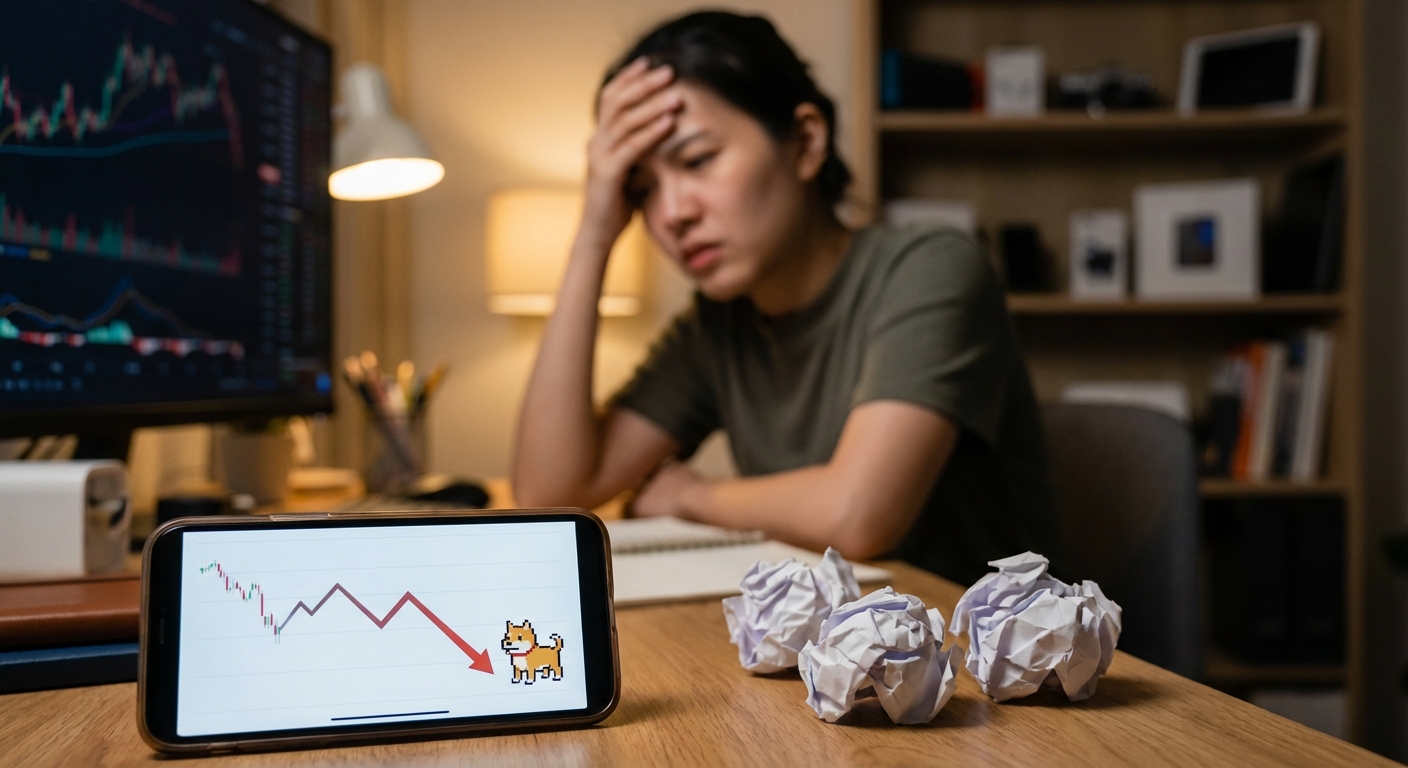

The Memecoin Supercycle isn’t coming to save you. It’s coming to liquidate you.

Everyone is waiting for the "retail wave." They think millions of "normies" will show up and buy their dog-themed bags.

It isn't happening. Not the way you think.

I’ve watched three cycles. I’ve seen the same patterns. I’ve watched $50,000 portfolios turn into $50 overnight.

The "Supercycle" is a marketing term. It was invented by the people who bought in at a $1M market cap so they could sell to you at $1B.

If you aren't winning, it’s because you’re playing a game you don't understand.

Here are the 3 reasons you’re doing it wrong.

1. You are chasing "Community" while the pros are chasing "Attention Decay"

Every Telegram group looks the same.

"Diamond hands." "To the moon." "Great dev."

This is noise. It’s a support group for people who are down 40%.

In a real Memecoin Supercycle, community is a lagging indicator. It happens after the price goes up. The price goes up because of a temporary, violent capture of human attention.

Memes are not companies. They are attention sponges.

Most people buy a coin and wait for a "community" to build. They wait for a roadmap. They wait for a utility.

You’re waiting for a ghost.

I don't look for communities. I look for "Attention Arbitrage." I look for the 15-minute window where a joke, a political event, or a celebrity screw-up captures the global consciousness.

If you are holding a meme for three months because you "believe in the mission," you aren't an investor. You’re a bag holder.

The market doesn't care about your loyalty. It cares about where the next eyeball is going.

Stop looking at the Telegram member count. Start looking at the speed of the narrative. If the joke is already three days old, you are the exit liquidity.

2. You’re manual trading in a world of algorithmic snipers

You see a coin launch. You copy the contract address. You open your wallet. You set the slippage. You click swap.

You’re already dead.

By the time your transaction hits the block, a bot has already bought and sold three times.

I spent $5,000 on custom scripts last year. Why? Because clicking buttons is for losers.

If you are using a standard DEX interface, you are bringing a knife to a drone strike.

The winners aren't "smarter" than you. They just have better tools. They are using Telegram sniper bots. They are using auto-sell triggers. They are watching "whale wallets" in real-time with push notifications.

You are reading a chart. They are reading the mempool.

If you want to win, stop looking for the "best" coin. Start looking for the best entry method.

The Supercycle isn't a tide that lifts all boats. It’s a vacuum that sucks liquidity from the slow and gives it to the fast.

If you aren't using a bot, you aren't trading. You’re donating.

3. You are addicted to "The Multiplier" and blind to "The Liquidity Trap"

You see a coin at a $5M market cap. You think: "If this hits $500M, I’m a millionaire."

This math is a trap. It’s the "Lottery Brain" at work.

You are focusing on the ceiling. The pros are focusing on the exit.

I’ve seen coins hit a $100M market cap with only $200k of actual liquidity in the pool.

That means if two whales decide to leave, the price drops 90% in one candle.

You see a "10x" on your screen. You feel rich. You try to sell. You realize there is no one on the other side of that trade.

The Supercycle is failing because people are buying illiquid junk.

They buy "MoonPepeElon" because it’s "cheap."

Nothing is cheap in crypto. Things are either liquid or they are dead.

I would rather buy a coin at a $500M market cap with $50M in liquidity than a "micro-cap" with $5k in the pool.

Why? Because I can actually leave the party.

Most of you are trapped in a burning building and you’re complaining that the wallpaper is the wrong color.

Stop looking at the gains. Start looking at the depth of the pool. If you can't sell $10,000 worth of a coin without moving the price 10%, you don't own an asset. You own a digital collectible.

The Insight: Memecoins are the new "Veblen Goods"

Here is what nobody is telling you:

Memecoins are no longer about "the people." They are the new luxury status symbols.

In the 80s, you bought a Rolex. In the 2000s, you bought a Ferrari. In 2025, you hold a specific "high-conviction" meme.

The "Supercycle" is actually a "Bifurcation."

99.9% of coins will go to zero. They are garbage. They are spam.

The 0.1% that survive aren't "memes." They are culture-tokens. They represent an identity.

Holding them is a signal. It says: "I was there first. I am part of this tribe."

The "Supercycle" isn't failing because memes are dead. It's failing because the middle class of memes is dead.

You either own the blue-chip culture-token, or you own a lottery ticket that has already been scratched.

There is no middle ground. There is no "undervalued" meme.

Value is subjective. Liquidity is objective.

The Question

Are you buying a coin because you want to be part of the culture, or because you’re hoping someone even more desperate than you shows up tomorrow?